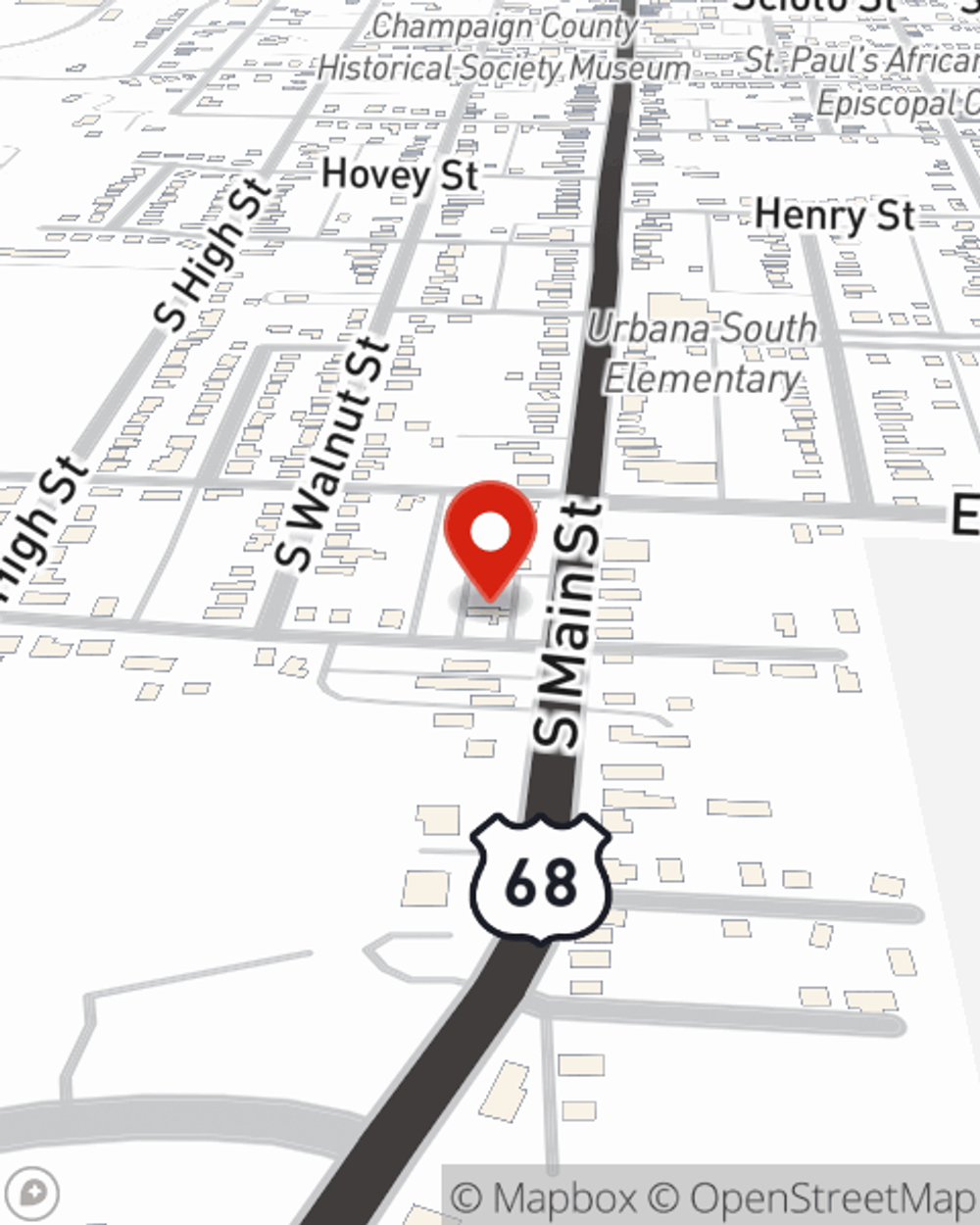

Business Insurance in and around Urbana

Looking for small business insurance coverage?

This small business insurance is not risky

Coverage With State Farm Can Help Your Small Business.

Operating your small business takes dedication, effort, and terrific insurance. That's why State Farm offers coverage options like extra liability coverage, errors and omissions liability, a surety or fidelity bond, and more!

Looking for small business insurance coverage?

This small business insurance is not risky

Cover Your Business Assets

When you've put so much personal interest in a small business like yours, whether it's a gift shop, a book store, or a barber shop, having the right insurance for you is important. As a business owner, as well, State Farm agent Erin Patton understands and is happy to offer customizable insurance options to fit your needs.

Get right down to business by visiting agent Erin Patton's team to learn more about your options.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Erin Patton

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.